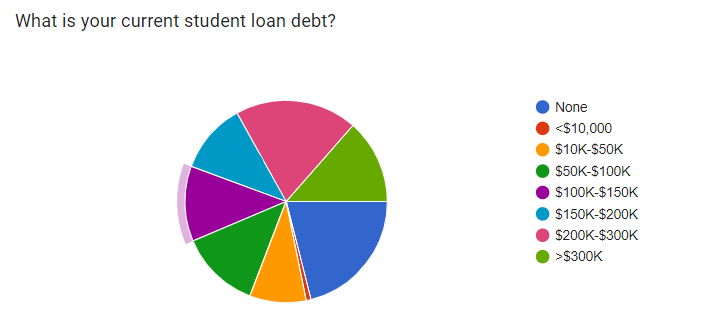

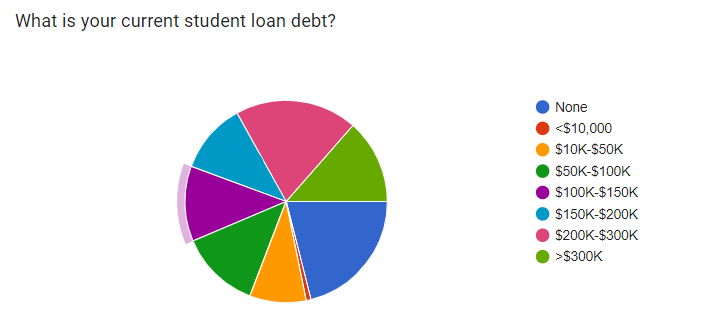

About one-third of the respondents to a recent Women In Optometry and Review of Optometric Business Pop-up Poll said that they have student loan debt of more than $200,000.

Nearly 20% of respondents said that their current student loan debt is between $200,000 and $300,000. Nearly 14% said their student loan debt tops $300,000.

Respondents were asked how they feel about the debt load they’re carrying.

38% of respondent said they are adding to the calculated monthly repayment plan when they can

- 30% are paying the monthly calculated payments, saying “It’s all I can do.”

- 23% are stressed over making the monthly payments

- 12% said they have a plan to pay off the remaining debt aggressively.

A number of respondents wrote in other answers, showing a range of emotions.

- “Never gonna happen”

- “I shall die before the last payment”

- “My interest rate is so low, it doesn’t make sense to pay it off aggressively”

“Paid it off aggressively last year”

COVID REPAYMENT PAUSE

Respondents were asked how they used the period during COVID when interest on student loans was set at 0%.

Nearly 43% said that they used that time to pay down their student loans.

27% used that time to pay other debts

15% said student debt was “out of sight, out of mind” during the interest pause.

Multiple respondents noted that they had refinanced their loans before the pandemic, so they were not eligible for the repayment pause.

Read more comments from respondents:

- “Keep living like a student, work 6 days/week, pay it off ASAP.”

- “Overpay on your loan payments especially for any that are unsubsidized or have higher interest rates.”

- “Live as meagerly as possible, add every extra penny you can to your student loan payments.”

- “I would not worry about it so much. I feel there is too much pressure on young ODs to pay them off quickly. Just pay your monthly payment and also enjoy your life. It will get paid off eventually.”

- “Be frugal and pay off as much as you can. You can buy the big house and nice cars later on.”

- “Get your interest rate as low as you can.”

- “Even though it is debt, one should borrow a little more than they need because once you graduate you will not be working immediately because it takes time to get your license, getting results from NBEO part III etc. So you will not be earning an income unless you are willing to work in a different job while you are waiting to get your license. Also, keep this in mind, the interest on student loan debt is far lower than other forms of interest loans.”

- “Good luck.”

- “Do what you can when you can, especially with large amounts, it’s not going anywhere any time soon.”

- “Accelerate payments. Pay it off early.”

- “Talk to financial advisor to come up with the best plan of action that will work best for you – your individual financial and life goals before you start repaying the loan.”

- “Get a job that offers PSLF or other student loan forgiveness.”

- “Take out the least amount of debt possible. Pay it off as fast as possible….do this by living like a college student until debt is repaid. No whining!”

- “Find a job that qualifies for PSLF.”

- “Ask your university why costs continue to skyrocket and why your degree is now so expensive that it is about impossible to find a job where you can pay it off in 10 years.”

- “Stay in state to reduce tuition fees if possible.”

- “Live with family after graduation to save on rent and pay that toward student loans.”

- “Pay it down as fast as possible, don’t wait for legislation or any bailout.”

- “Pay more than the monthly payment if you can, look at all the repayment options and if you get a job that counts towards PSLF, make sure your repayment plan is covered.”

- “Talk to a good mentor and financial advisor to understand money.”

- “It’s too late. Our debt to income doesn’t make sense.”

- “I would recommend paying your loans off very aggressively. You will have future debts to deal with after this, like a home, cars, and expenses from children, etc.. It’s so important to pay off your loans!! Be responsible, work hard to be debt free and have good credit in your future. It will really be worth it!! Don’t eat out every day, use it for special occasions. Bring your lunch, and you will eat healthier and be healthier and tend not to gain weight over the years.”

- “Pay it off as soon as you can. The sooner they are gone, the more doors and opportunities open for the future.”

- “Live within your means. Focus on paying debt as a priority.”

- “Take as little as possible.”

- “Make sure this is REALLY what you want to do. The loans can be very overwhelming and will take a while to pay off.”

- “Buckle up for the long haul.”

- “Refinance student loans at graduation to a lower interest rate and make a plan to attack debt fast and pay them down aggressively.”

- “Pick a position that makes you happy, allows you to pay what is needed and hopefully has a good work life balance, don’t stress too much.”

- “Pay aggressively early on if possible. (ex: lived with parents an extra year or two and paid as much as possible)”

- “Try to aggressively pay as much as you can while you are young. It gets more complicated when you’re older with a house and kids.”

- “Pay it off as soon as you can and before accruing more debt. Continue to live like a student as much as possible, which is hard to do!”

- “If able try to work an extra day use that money to make additional payments. Set up a meeting with a financial advisor and have a game plan. I wished I had done this the minute I accepted financial aid loan to attend optometry school. The interest is overwhelming.”

- “Don’t live above your means. You can still have a good quality of life with debt.”

- “Take the least amount you can because it’s just more you have to pay off.”

- “Borrow only what you need.”

- “Be realistic on the lifestyle you want and how to pay it back! View debt as an investment into yourself, but don’t push it off forever. Look into repayment options working through places like the VA. Remember that it takes time, it’s a marathon not a sprint.”

- “Listen to Dave Ramsey. Don’t do the SAVE plan—get out of debt.”

- “Try to not let it get out of hand. However, even though I have very high debt levels, I would still prioritize job satisfaction over salary.”

- “Live below your means, live with parents if possible the first few years.”

- “Save for retirement and pay off your loans— don’t wait to start your 401K.”

- “Since it’s too late to tell you to get a different career, the only advice I can give is since you’ll be drowning in debt either way, take the minimum payments and try to live your life the best you can.”

- “Hire a certified financial planner experienced with student loans.”

- “Live like you’re still a student for the first few years so you can pay down debt.”

- “It is best to get student loan debt and have enough after you graduate since you will not be drawing an income immediately since you have to wait for your license. Also interest on student loans are usually far less than what you get from outside lending institutions.”

- “Pay it off as quickly as you can, without living as a pauper or too poorly. Decrease the frequency of your eating out habits to rare, and you will be able to pay off your loans in a very timely fashion. And you will be happy that you did it!”

- “Try to keep living modestly for a few years and work hard right out of school, I’m only 5 years out and nearly debt free so I can start living whatever lifestyle I want!”

- “Please focus on paying it as a priority early.”

Nearly three-quarters of the respondents said they were female ODs.

Read more polls and results from WO here.

Have a poll idea? Curious about something? Email us here.