95% of respondents to Pop-up Poll said they graduated with debt

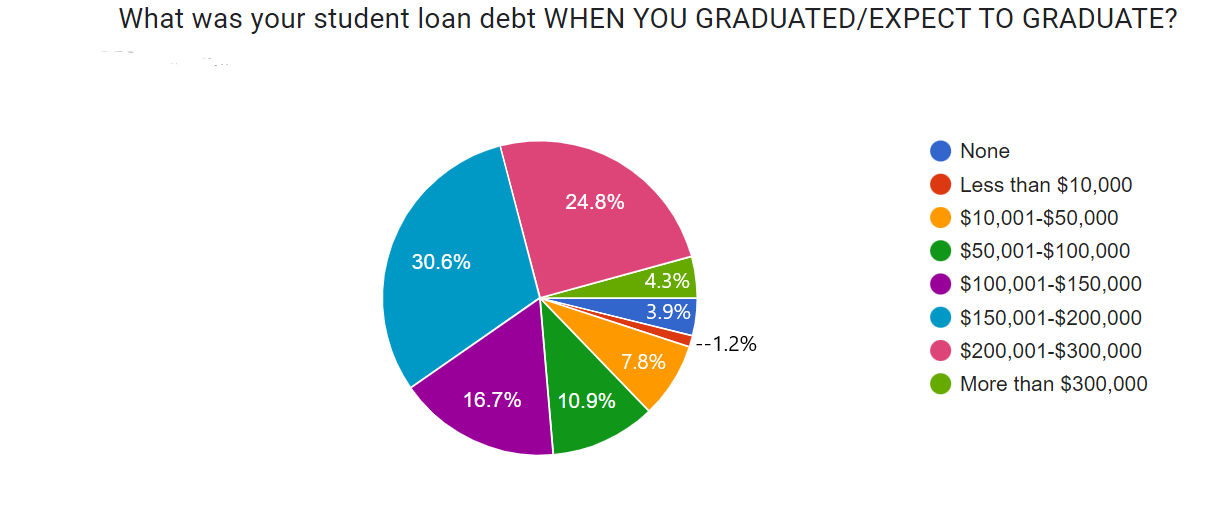

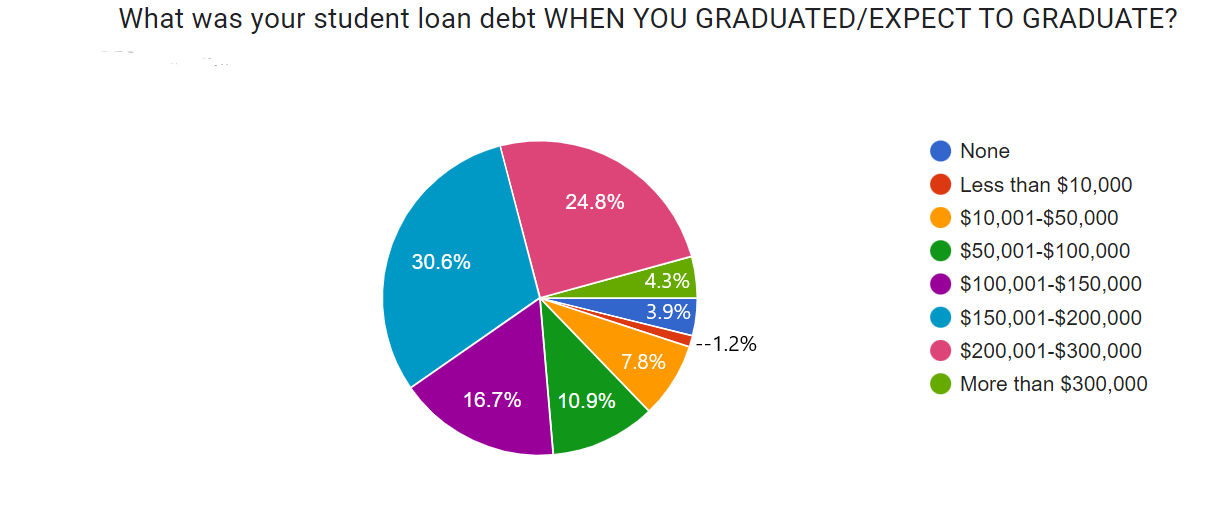

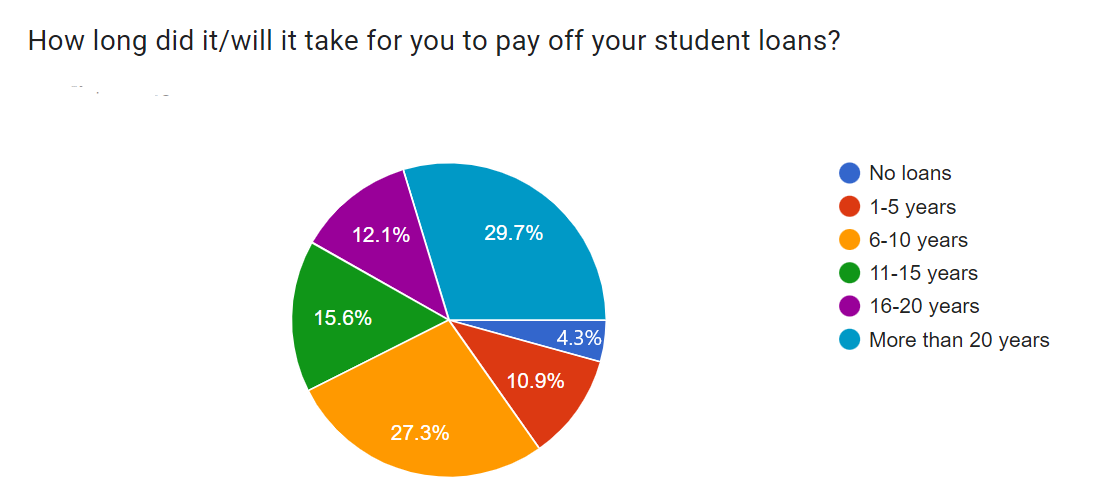

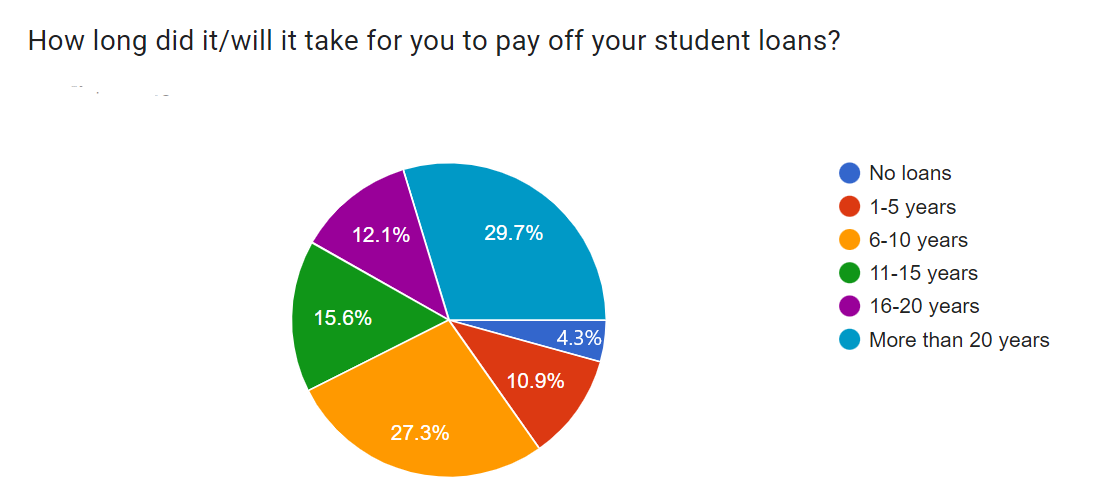

Nearly 30% (29.1%) of respondents to a WO Pop-up Poll shared by Review of Optometric Business said that they did or anticipate graduating optometry school with at least $200,000 in student loan debt. A slightly larger percentage, 29.7%, said they expect that paying off their student loan debt will take at least 20 years.

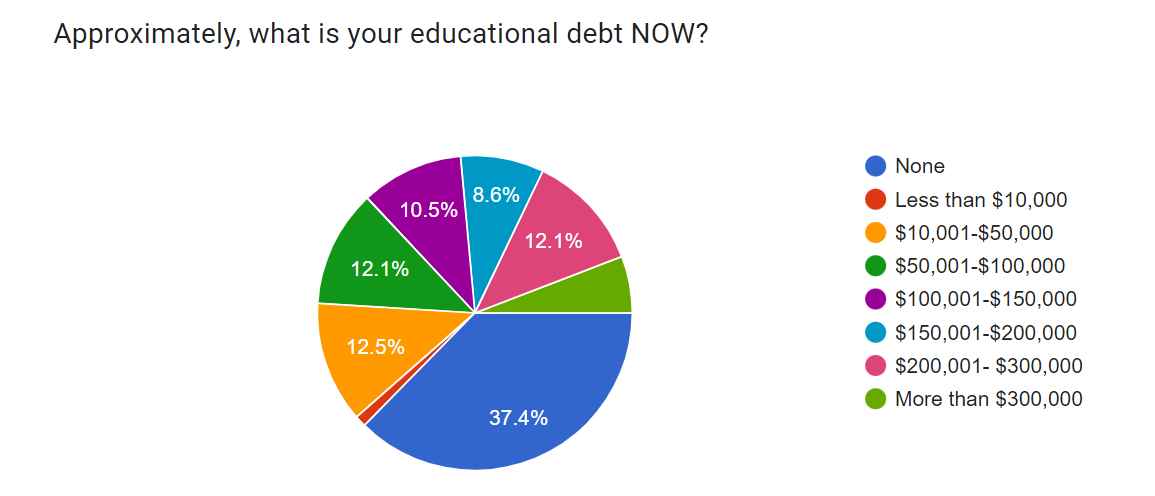

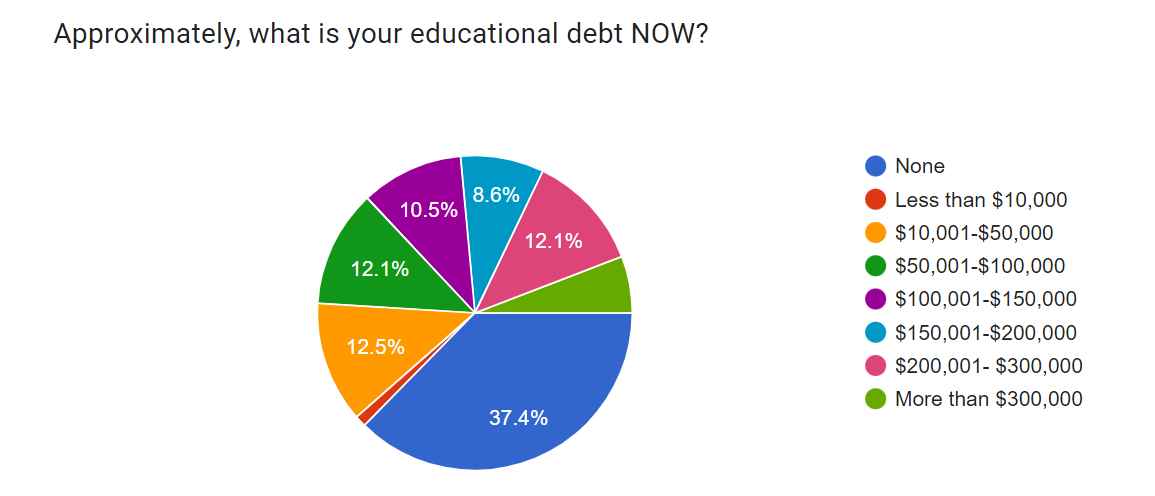

While nearly 38% of respondents said that they have no student loan debt at the moment, 18% said their debt load tops $200,000 today.

Chart above shows the responses from 258 respondents on their educational debt now. Chart below shows the debt at graduation.

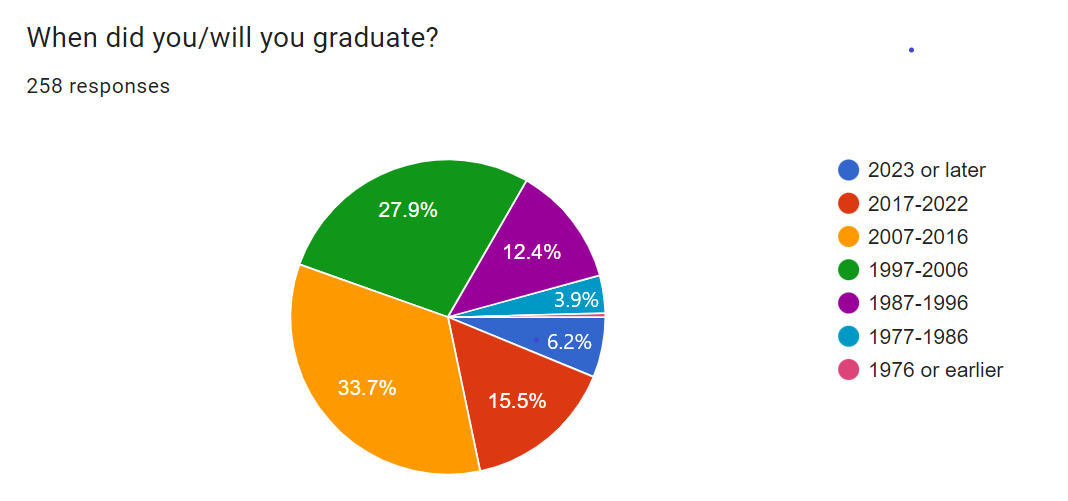

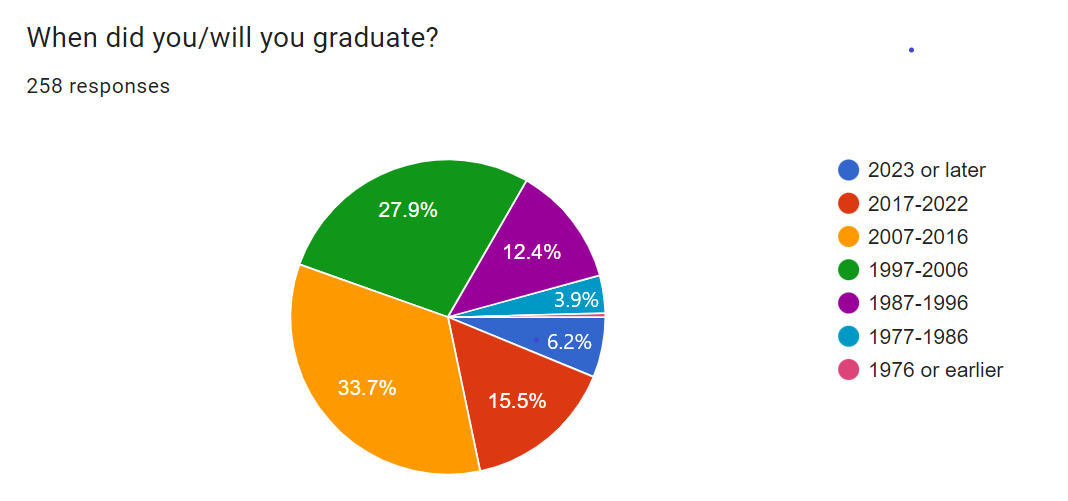

Nearly 56% of the respondents graduated since 2007.

HELP WITH STUDENT LOAN DEBT?

This Pop-up Poll was issued before the U.S. Supreme Court struck down President Biden’s plan to help students in lower income brackets with up to $10,000 or $20,000 of student debt forgiveness. That decision came while this poll was still open to comments and responses. Twenty-seven percent of respondents said that they have applied for some time of student loan/debt relief program.

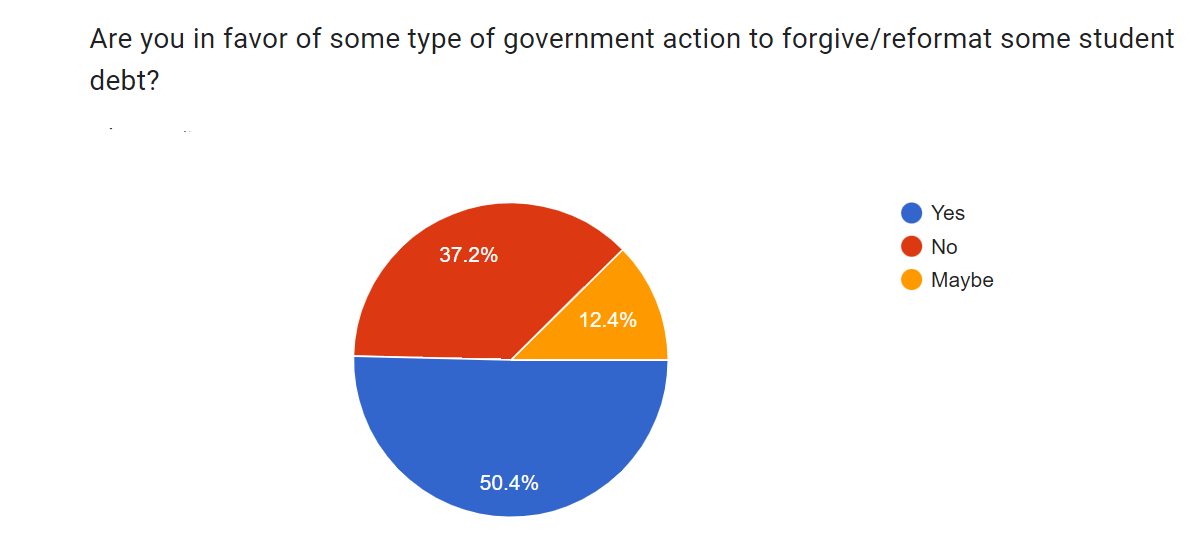

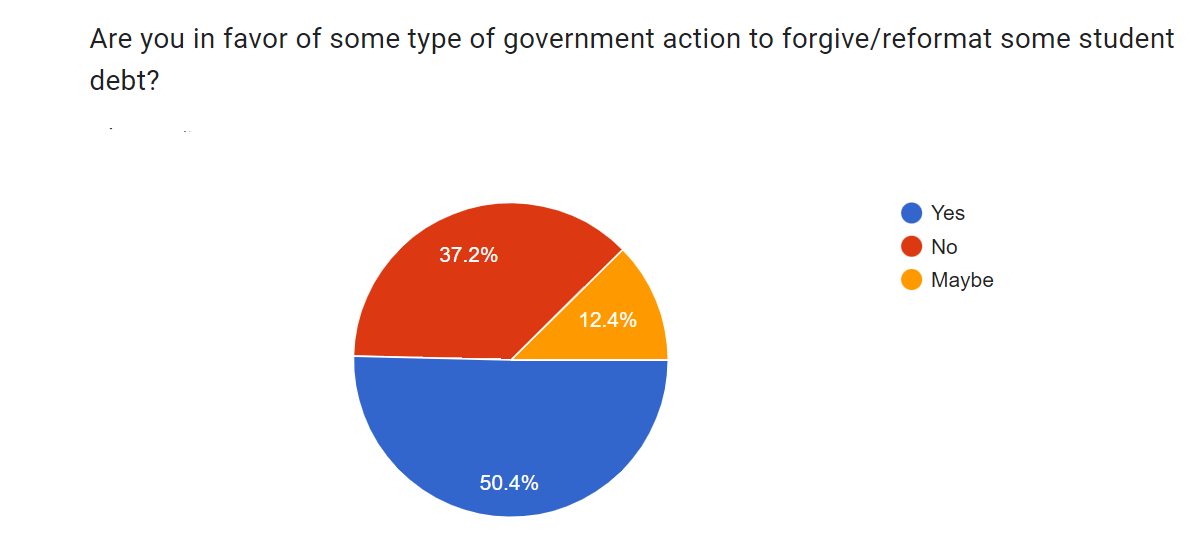

More are amendable to the government doing more to help with student loan debts, as this chart shows. More than 50% say they are in favor of some type of government action to forgive or reformat some student loan debt, and another 12% said they might be.

Of the respondents, 71.2% said they were female ODs, 24.9% said they were male ODs, and 1.2% of the OD respondents said they preferred not to specify gender.

Debt holding some back

The poll offered respondents a chance to share whether or how their student loan debt is holding them back or how they managed it. Here are some of those responses.

Salaries are too low

Salaries are adequate

Work-life balance impacted

“Student loan debt is the reason why I wish that I had never gone to Optometry school. I should’ve been an electrician, in my area, I’d make the same amount of money without the decade plus mortgage payment. I am extremely frugal by nature, but I find myself much further behind my friends who simply have a bachelor’s degree and are working in other fields. I have a 16 year old daughter, she’ll start college in 2 years, I’m afraid that I won’t be able to help even as much as my blue collar parents did for my education. I just hope my alma keeps sending me reminders to donate.” –– Male OD, a 2007-2016 graduate who still owes more than $50,000 on his original $200,000-$300,000 loan

Working six-day weeks. Not going on vacations other than just visiting family. Can’t afford trips right now. It’s kept us from buying a house for several years or from me wanting to start my own business. Last thing I need is a business to fail and I’m stuck with that burden as well. With the monthly payments for student debt, and rising costs, it’s hard to have any breathing room. But I’m also against the government forgiving the debt. I borrowed it willingly. I should pay it back. I think they should find a way to cap the interest at 2% though so it’s manageable to pay back.” – Male OD, 2007-2016 grad with between $150,000-$200,000 left on loans that were originally $200,000-$300,000.

Not the government’s role

Student loan pause helped

Interest rates are the killer

“Cap interest rates, no capitalization after graduation are ways to constructively deal with debt. I have only made minimum payments because interest rate is very low, it may actually go up when payments resume because of Biden’s delay of payments.” – Female OD, graduate in 2017-2022, whose student loan debt has increased to between $200,000-$300,000 now, more than when she graduated.

Even if they made student loans low interest ( 1-2%) it would make paying off student loans much easier.” – Male OD, paying down the last bit of a $50,000-$100,000 loan, lasting more than 20 years since graduation.

Knotty problem

“80% of my student loan debt was at 16.9% interest. I worked 6 days a week for 8 years to pay that off, and another year to pay off the balance of my loans. My loans delayed all other facets of living, i.e.: I delayed getting married, starting a family, buying a house, buying/starting a practice, saving for retirement. I am both bitter about my student loans causing massive strain in my early professional life and profoundly happy that my two daughters will graduate without a dime in debt (I saved for their educations, and I’m helping my oldest pay for Medical School). I don’t see how any OD graduating today can pay their student loans totaling over $250k. I don’t see how I can have a young OD buy my practice in 10 years.” — Male OD, 1987-1996 grad who paid off $100,000-$150,000 in loans in 6-10 years.

Good lessons

“I was unable to purchase a larger house. I worked 13 days every 2 weeks for quite a few years and had 5 jobs to make ends meet in a very saturated market. It prevented me for expanding my family and resulted in significant family stress for many years, in addition to be able to focus on contributing fully to a retirement account.” – Female OD, 2007-2016 grad, who paid off $100,000-$150,000 in loans in 11-15 years.