By Natalie Hayes Schmook, MBA, CFP, CVA, Hayes Wealth Advisors

The IRS increased limits on retirement plans for 2023, so halfway through the year is a good opportunity to be sure you’re on track. Even if you’ve been contributing under the old limits, you have several months to boost your contributions.

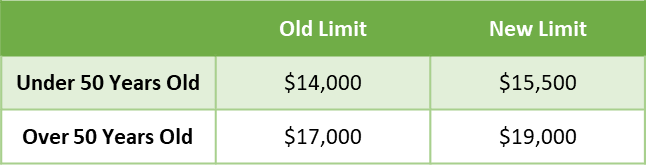

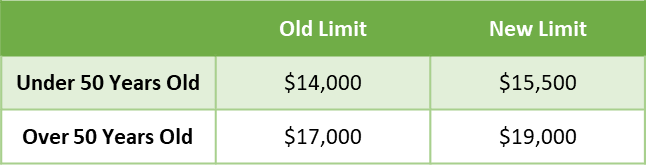

SIMPLE IRAs

It’s important to consider total compensation so that you are maxing right at the end of the year and not earlier. Maxing earlier could cause participants to lose out on the match the final paychecks of the year.

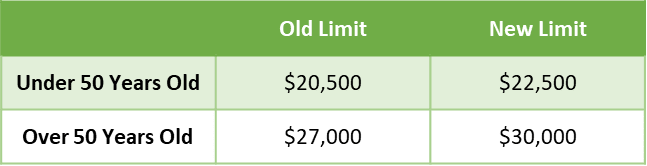

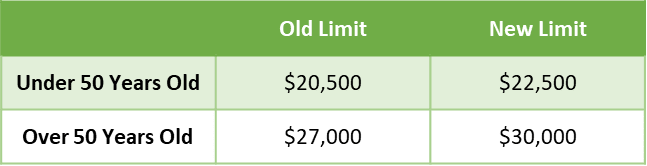

401Ks

Once again, use the calculation based on total expected compensation to max contributions. If you’re unsure, undershoot a bit—you can always defer more to catch up in December but if you max out contributions early, there’s usually no going back on the match.

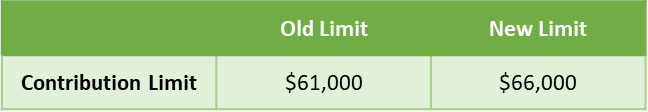

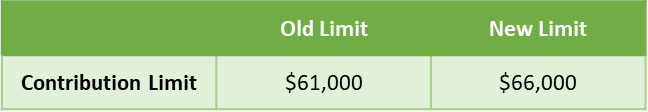

SEP (self employed) IRAs

SEP IRAs don’t work with most practice owners but where they do they can work really well. SEPs are made based on pay (or net income of an sole prop/LLC not filing as an S) capped at 25% of income and have to benefit staff that make more than $5,000/year and have been employed 3 of the last 5 years. These tend to work well for practices that are new or have had high staff turnover and do require a bit of advanced planning.

SEP contributions are calculated after the calendar year is complete and should be done by your CPA. There are no catch-up contributions in a SEP.

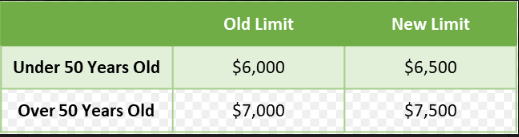

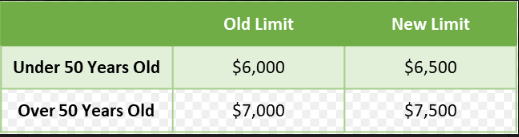

Traditional and Roth IRAs

There can be some confusion about the role of traditional and Roth IRAs so it’s worth recapping a bit. A traditional (or rollover) IRA is tax deferred, meaning the money that goes in is taxed like a paycheck when it comes out unless you make a non-deductible contribution that would come out tax free (and then it’s your responsibility to keep up with those which can be challenging). A Roth is funded with after-tax money that grows tax free forever.

Roths are a great vehicle and I like to see everyone who can participate do so. To directly contribute to a Roth for 2022 your adjusted gross income (line 11 on your tax return) must be less than $204,000 for married filing jointly and $129,000 for single filers with some phase out levels. Married filing separately tax payers cannot contribute directly to a Roth.

I’m using 2022 numbers here because, as you might imagine, many taxpayers don’t know where they fall in their AGI, so the deadline to contribute to these vehicles is April 15th of the following year.

There is not an income limit on contributing to a traditional IRA but there are some limits on contributions being deductible. First, if you or your spouse participate and any kind of employer sponsored plan (401k, Simple, SEP, etc) it impedes your ability to deduct traditional IRA contributions. In some cases, spouses can take the deduction if household income is less than $204,000 (2022) and single tax payers can take a deduction if incomes are less than $109,000 (2022) with some phase out levels.

Not done correctly non-deductible contributions to a traditional IRA are not good—you’re essentially taking money you’ve already paid taxes on and having it taxed again when you withdraw it.

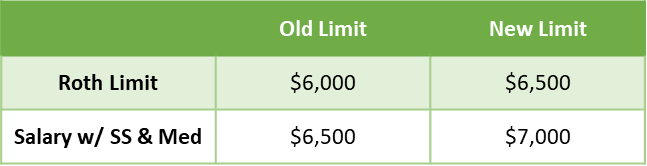

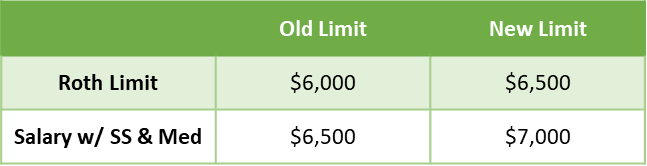

Funding kids Roths through payroll

I saved the best for last for practice owners with children. One strategy I use with many clients is to put kids on payroll, have them work, pay fair market wages and use those wages to fund a Roth IRA. It’s a very nice tax strategy for high income owners and a flexible way to save for college.

Typically, kids need to be paid in such a way that they are withholding for Social Security and Medicare taxes (but not for every business structure), but don’t need to withhold not federal and state if they are below filing requirements. Please consult your financial advisor or CPA about correctly setting up this strategy if you want to pursue it.

Please note these salaries are clean, whole numbersand may amount in a tiny overfunding at the end of each year which can be easily rectified with a reversal. Additionally, if you are going to pay children, they really need to be working for the practice.

Related: Read about rolling kids’ 529 plans into Roth IRAs here.

Read more financial stories in the Your Money channel on WO Resources.

Featured image: PM Images, Getty Images